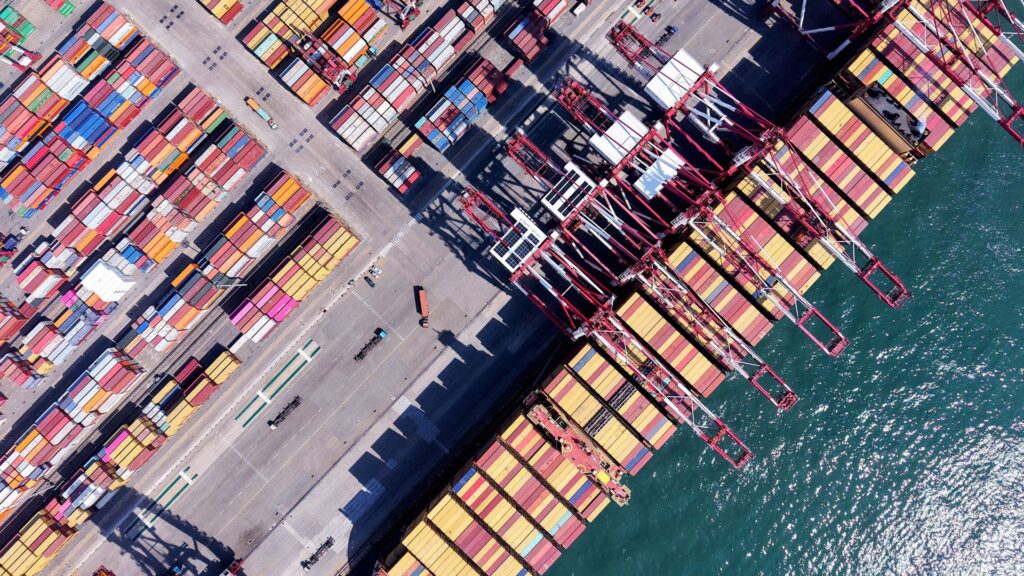

Chinese companies are working to avoid Trump administration tariffs by shipping their products through third countries, ultimately hiding where they originally came from. A new report from the Financial Times reveals that social media sites based in Beijing are rampant with advertisements for “place-of-origin washing.” Now, countries near China are raising concerns over being used as ploys to conceal Chinese products sent to the U.S.

Why ‘wash’ product origins?

Chinese exporters worry new tariffs of up to 145% imposed by the United States threaten to cut their products off from American markets. So some shipping firms are encouraging Chinese goods makers to send their products to another country where a new “made in” label can be slapped on before heading to the U.S.

One Chinese lighting salesperson told the Financial Times, “We can sell the goods to neighboring countries, and then the neighboring countries sell them on to the United States, and [the tariff cost] will reduce.”

But according to U.S. trade rules, more is supposed to happen than merely sending products through another country before a new origin label can be affixed. Products sent through a third country must be substantially “transformed” before they can be relabled. The law stipulates that the processing or production in that country must add substantial value and quality improvements in order for the product to be considered to have originated from that nation.

How are third countries responding?

The home countries of shippers seeking China’s “origin washing” business are wary of violating U.S. trade rules.

Malaysia’s Ministry of Investment told the Financial Times that it is “unequivocally committed to upholding the integrity of international trade practices,” adding that it “views any attempt to circumvent tariffs through wrong or false declarations, whether related to the value or origins of goods, as a serious offense.”

“If there is truth behind those reports, we will investigate and take the necessary action, in collaboration with our customs and the U.S. authorities,” the ministry said.

Malaysia isn’t the only Southeast Asian country being used by Beijing. Reuters reports, South Korean authorities revealed in April 2024 that they discovered foreign products worth more than $20 million with counterfeit nation of origin documents in the first quarter of 2025. The country’s customs agency says most of the goods came from China and nearly all were destined for the U.S.

Vietnamese authorities also recently told exporters, producers and trade companies to enhance security measures on “raw materials” and other goods to check for false certificates of origin.

How are American businesses responding?

These tactics to avoid Trump administration tariffs are also worrying American businesses. A senior executive who sells his products on Amazon told the Financial Times that a Chinese supplier may try to hide the true value of a product, saying, “You’re putting a lot of trust in a Chinese supplier.”

China’s foreign and commerce ministries did not respond to the Financial Times report.

What other tactics are being employed?

The report also comes as Chinese companies like Temu are “recruiting” U.S. companies to “join the platform.” Temu says the new effort is “compliant and efficient” with tariff policy while helping “local merchants reach more customers and grow their business,” according to CNBC.

Temu stopped shipping orders to American consumers from its warehouses in China, as Straight Arrow News recently reported, following the Trump administration’s decision to end the de minimis loophole. The tax exemption, which allowed nations like China to send packages valued at under $800 to the U.S. without duties, expired Friday, May 2.

What happens next?

Temu is currently fulfilling orders through its U.S. inventory, and trade analysts are watching to see how quickly the company burns through what it has sitting in domestic warehouses, Bloomberg reported. They warn that Temu may move on from the U.S. market and focus on other regions if it can no longer avoid the impact of tariffs.

Analysts also say Chinese companies’ shipments to the U.S., and continued tactics to avoid them, will depend largely on the effectiveness of U.S. Customs and Border Protection enforcement of the policy.