US stocks have fallen out of the Top 40 with investors worldwide this year – and chart watchers can blame President Trump’s flip-flopping song and dance on tariffs.

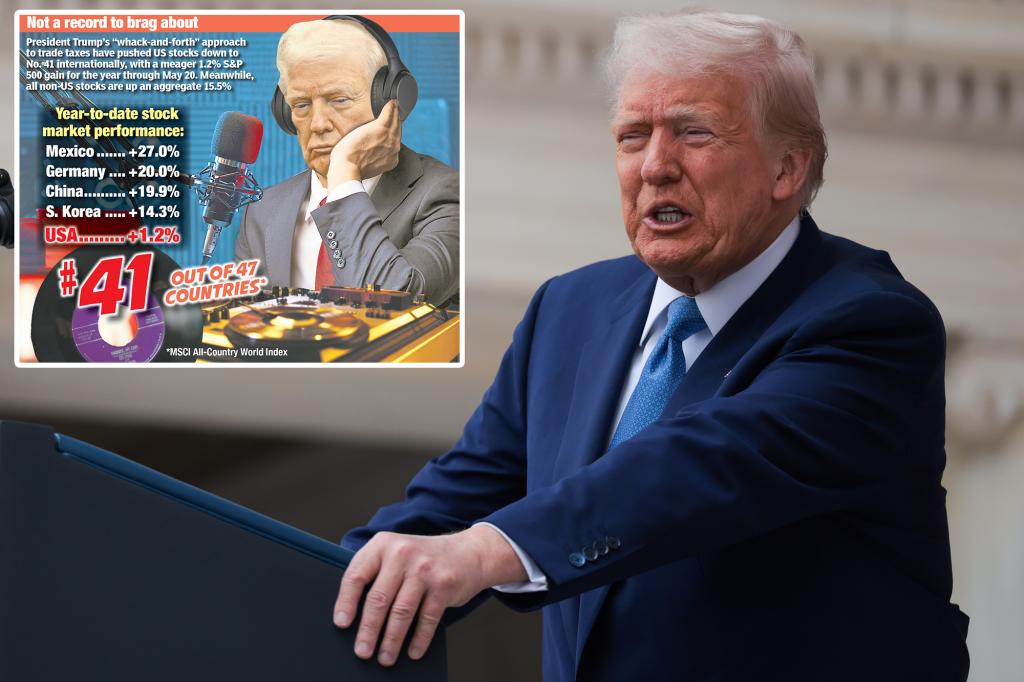

This year through May 20, Chinese stocks are up 19.9% while neighboring South Korea’s are up 14.3%. Europe’s are up 22.3% including Germany’s, which are up 20%. Mexico’s, for the love of avocados, are up 27%. Altogether, non-US stocks are up 15.5%.

The S&P 500? It’s barely in positive territory – up just 1.2%. Of the 47 MSCI All-Country World Index countries, America’s year-to-date return ranks No. 41.

How did US stocks drop from platinum and gold to the bargain bins? Take a look at Trump’s on-and-off, whack-and-forth approach to trade taxes. My April 21 column detailed Trump’s tariff illogic and why tariffs always hurt the imposing country most.

A week after “Liberation Day” on April 2, the White House on April 9 issued a 90-day reciprocal tariff pause. Since then, just two tariff “deals” emerged—Britain and China. But at the end of the day, these are deals to make a deal – little more.

In the case of the UK, the deal is one-year only, non-binding, easily cancelled and affects only a few items–until a full trade deal can be made. Meanwhile, most prior UK tariffs roll on.

As for China, pundits were enthused about the deal, but it merely lowered the tariffs to 30% – far below the absurd 145% levy that amounted to an effective embargo – but still substantially higher than January’s. This also was yet another deal to make a deal in 90 days.

Neither deal, otherwise, is worth the paper it’s printed on.

On May 16, Trump flip-flopped yet again. Boasting that 150 nations wanted “deals,” the president said he didn’t have time to negotiate them while he was jetting off to the Middle East. His “solution”? Telling all nations he’d tell them next week what rates they will pay – supposedly “very fair” ones – and offering some countries chances to appeal.

Didn’t he already do just that on “Liberation Day” How did that work? And how will this work? He doesn’t say, further fanning uncertainty.

Maybe real deals come, actually lowering trade barriers and uncertainty – a huge potential upside. Maybe not.

Either way, as I noted in April’s column, there are reasons to be bullish here, although they’re not among the major White House talking points.

Importers, for one, can readily skirt America’s understaffed, overwhelmed tariff collecting Customs and Border Protection crew via both illegal and legal means.

The latter include “tariff splitting” – stripping out services-related costs like marketing to reduce goods’ values. Or storing imports in bonded warehouses. Or shipping in values under $800. And hundreds of illegal ways like misclassifying, undervaluing goods.

There’s also, for example, “transshipping,” which underpins China’s tumbling exports here while southeast Asia’s surge, like Vietnam’s 34% year-over-year spike – while China’s total exports keep growing. Some importers opt for “masquerading” through Canada or Mexico, gaming the USMCA tariff exemption.

Hence, while April’s total tariff collections rose to $16.3 billion, they missed White House forecasts by 75%. That will continue as importers implement more skirting strategies.

In the meantime, all of the uncertainty is hammering America hardest in all sorts of ways. What seems confusing here can register as beyond belief overseas. Stocks hate rising uncertainty – always.

(Despite my Republican disappointment, I am pleased that my January column correctly predicted European stocks leading this year’s bull market. As my 1950s childhood hero and New York’s wisest Yogi ever said, “It ain’t bragging if you really did it.”)

What comes next with tariffs? Who knows – maybe not even President Trump. Are we making America great again? We’re No. 41! Kinda like California’s relative school test scores – or most economic outcomes there nowadays.

On the positive side: Even if all tariffs return, the pain will be less than feared – which is bullish. What to do? As I advised at the start of 2025: Be patient, and enjoy the bull market overseas for now.

Ken Fisher is the founder and executive chairman of Fisher Investments, a four-time New York Times bestselling author, and regular columnist in 21 countries globally.